Overview

As automotive industry is going through a digital AI-driven transformation, car brands such as Honda, Toyota, Proton and Perodua are leveraging on social analytics to gain more consumer insights to retain market share, capture new set of audience and ultimately drive more sales.

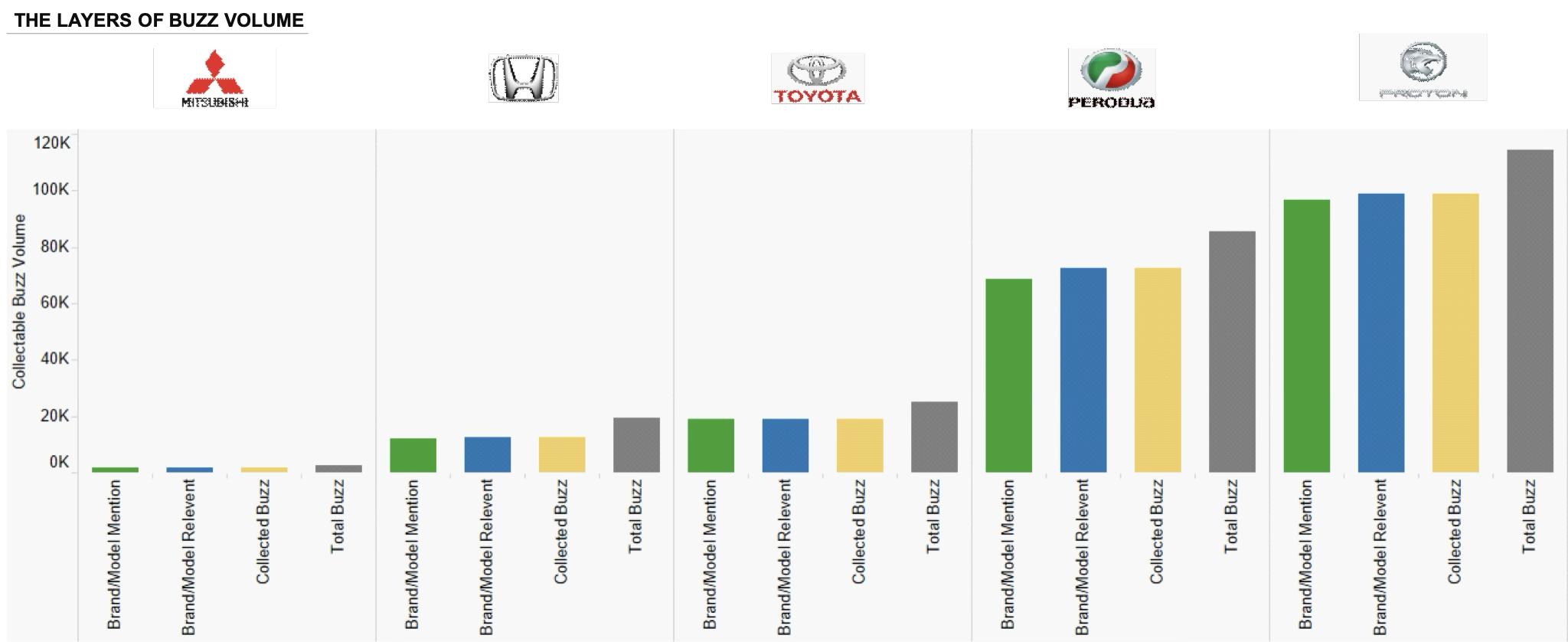

In Malaysia, Proton and Perodua dominate most social conversation followed by Toyota, Honda and Mitsubishi – key brands that leverage on social platforms to market, educate and engage customers. Our research analysis showed that car models such as Proton X50, X70, Saga and Perodua Axia, MyVi recorded the highest volume of mentions and social conversations (across most social platforms) due to the affordable prices and growing interest of consumers in the introduction of new national cars Proton models.

Major car brands such as Toyota is going all out using social media monitoring tools to capture more sales by understanding consumer purchasing behaviour and sentiment.

Other premium brands such as Mercedes and BMW are leveraging on social insights to compete for higher end of the consumer segment, particular in the SUV type A and SUV type B categories.

Businesses and automotive marketers can now use social analytics to listen to consumer preferences, largely captured from social conversations across forums, Facebook comments, TikTok videos, Youtube comments and other social platforms.

Processing, cleaning and understanding these data and patterns are crucial steps that need to be undertaken by car brands and vehicle manufacturers to help them for future product development, improve customer service and gain access to critical attributes (eg: design, exterior colour, interior layout and usability, safety feature, engine performance, battery life) that leads to the final purchasing decision by consumers.

However, deep-dive industry acumen in the automotive industry is a prerequisite for social media monitoring companies to be deemed helpful to car brands apart from showcasing deep technical (technology) capabilities for its tools.

Online surveys are obsolete. Using social data analytics now gives opportunities for automotive marketers to capture new customer segments directly from social platforms.

“Online marketing drove user awareness for car buyers in Malaysia, but there are other parts of the customer journey underpinned by preferences and what they read on digital media which can be further analyzed using advanced social analytics” said Shahid Shayaa, the founder and CEO of Berkshire Media.

According to data analytics experts, Malaysia is a mature market and automotive car brands can learn more by harnessing the potential of social data analytics to gain sufficient data and trends on consumer preference before launching a new model.

Social listening tools can be used as a market research tool to plan the launch of new models using attributes that are close to what consumer love the most. Shaping the right narratives and giving the consumer the right product leaves a strong lasting impression for them to test-drive new cars.

Apart from Toyota, Chinese EV car brands such as BYD and Cherry are joining the bandwagon too, using AI-driven insights from social listening tools to understand consumer purchasing behaviour. And this trend illustrates the power of data-driven marketing that is fueled by output from social data analytics.

However, before choosing, subscribing or even blindly buying social listening tools such as Meltwater, Hootsuite, Talkwalker and others to enhance your marketing activities in the automotive industry, there are things you should know.

We shall also cover buying tips, which type of social listening that are helpful for car brands or the best in the automotive industry, and what to look out for.

Which type of social listening tool or data analytics is best for car brands and the automotive industry?

Given the high social media user penetration in Malaysia and the vibrant automotive industry, the most common and effective way to gain better consumer insights is to source conversations from social media platforms.

For data-driven marketers in the automotive sector, social listening gives you the basic capabilities to start your journey. So, if you are new to marketing, you may be exposed to basic reporting on social media mentions.

Now, what you see from your reports may be limited.

On the other hand, social data analytics brings higher value to marketers in order to drive strategic actions for marketers in Malaysia, especially when competing in a highly saturated and competitive market.

Social listening tools or services are two best type of solutions that can be used to analyze consumer data for car manufacturers. It is widely used by big brands such as Proton, Honda and Toyota.

Based on whats relevant to the end user of car manufacturers in Malaysia, there are broadly two types of social data analytics that are deemed useful to car brands.

Here is a quick summary of the types of consumer social data analytics for car brands in the automotive sector together with the pros and cons.

| Type | Pros | Cons |

| Social Listening Tool (System) |

|

|

| Social Data Analytics (Services) |

|

|

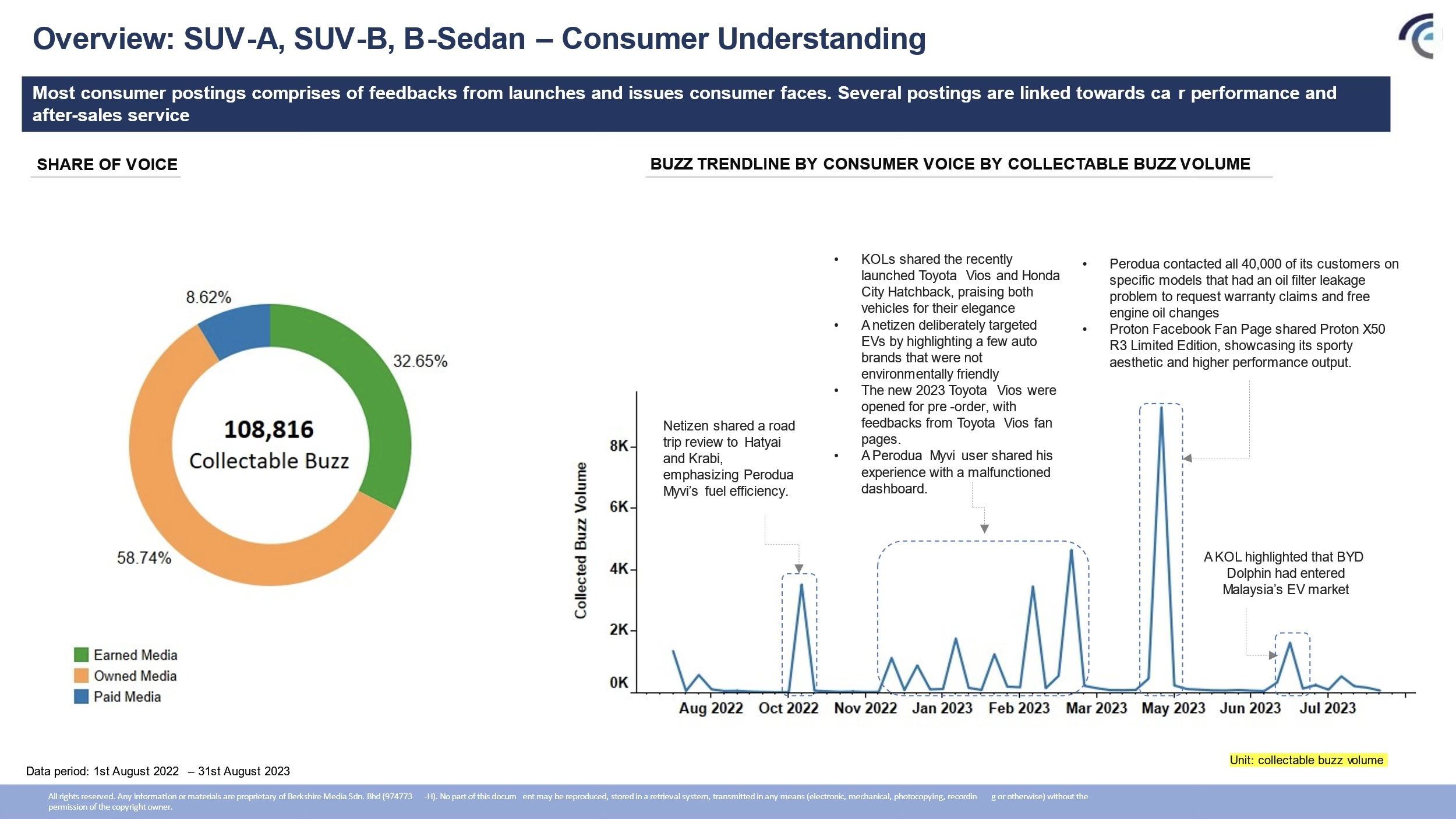

In essence, using social listening tools in the automotive car industry is mainly useful to customer-facing operations (eg: to track complaints or after-sales support), but in recent years, social analytics are used widely to extract social data related to car brands, and this can be used to gauge better understanding how earned media, owned media and paid media are used to drive consumer behaviour including brand loyalty.

But there is one thing important when choosing the best social media monitoring partner in the automotive sector.

To get the most and the best solution for automotive, partner with companies with social analytics services with data cleaning (processing) capabilities and that understand local dialects, nuances with regards to car brands and purchasing behaviour.

Highly experienced social analytics companies such as Berkshire Media leverages on millions of social data to help car brands such as Honda and VinFast to understand the automotive industry landscape and consumer insights into what triggers them to purchase a particular car brand.

“We analyzed more than 20 automotive car brands in Malaysia to get a better understanding on conversation triggers and what type of attributes that drove purchasing decision” said Soalat Shayaa, Head of Analytics of Berkshire Media.

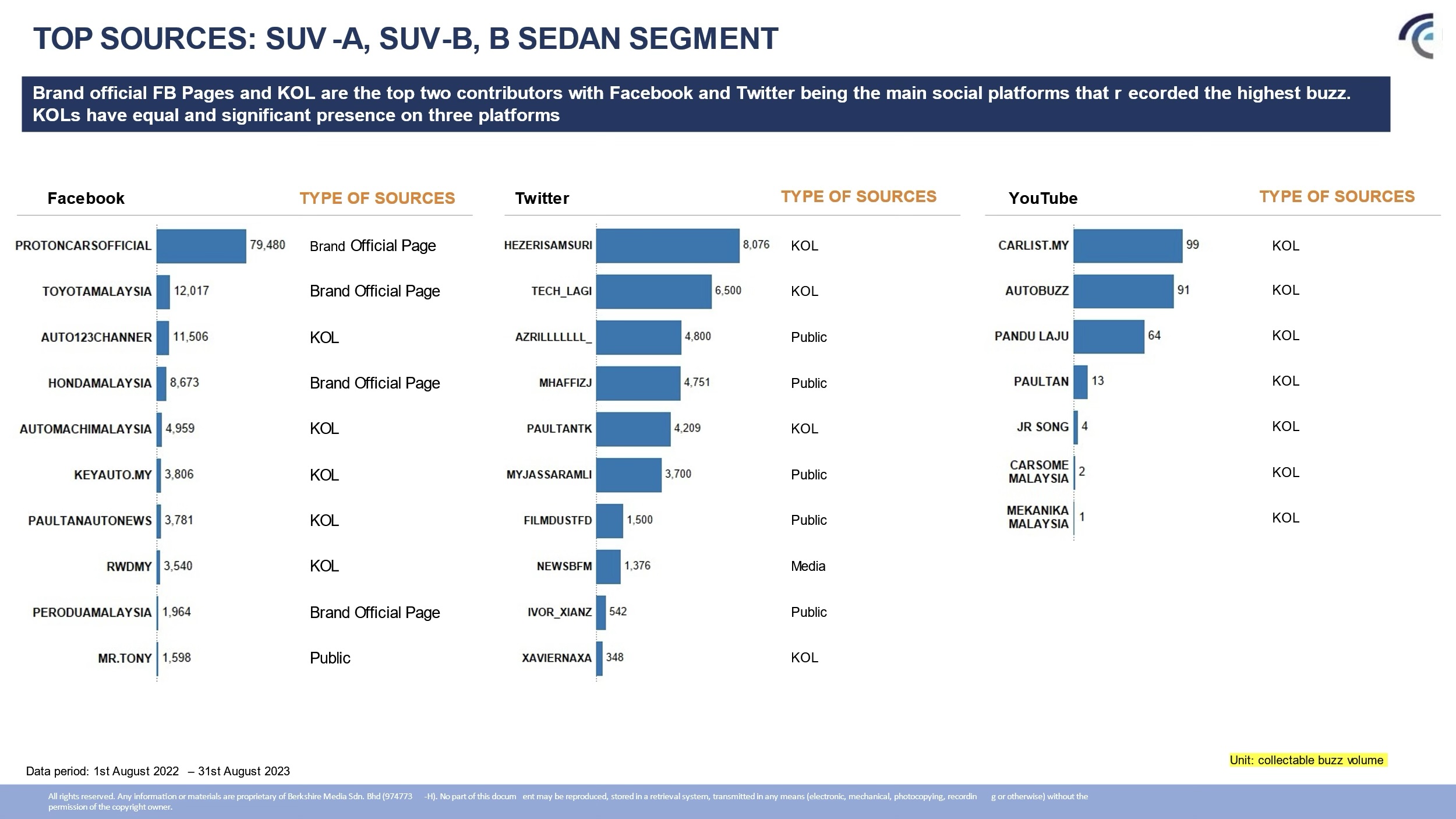

He added that Proton, Toyota and Honda are actively using their official social media channels (mainly Facebook) to capture consumer’s attention to test drive new car models with creative marketing strategies whilst car review blogs such as Paul Tan remains one of the top key influencers in driving more user engagement and conversation about a particular car models.

“In a highly competitive market, car brands use social listening tool and combine with advance data analytics to understand what triggers them to make the purchase”

How does Social Listening Helps Car Brands?

Applying social listening tool with advance social analytics allows car manufacturers and brands to identify factors that determine purchasing behaviour.

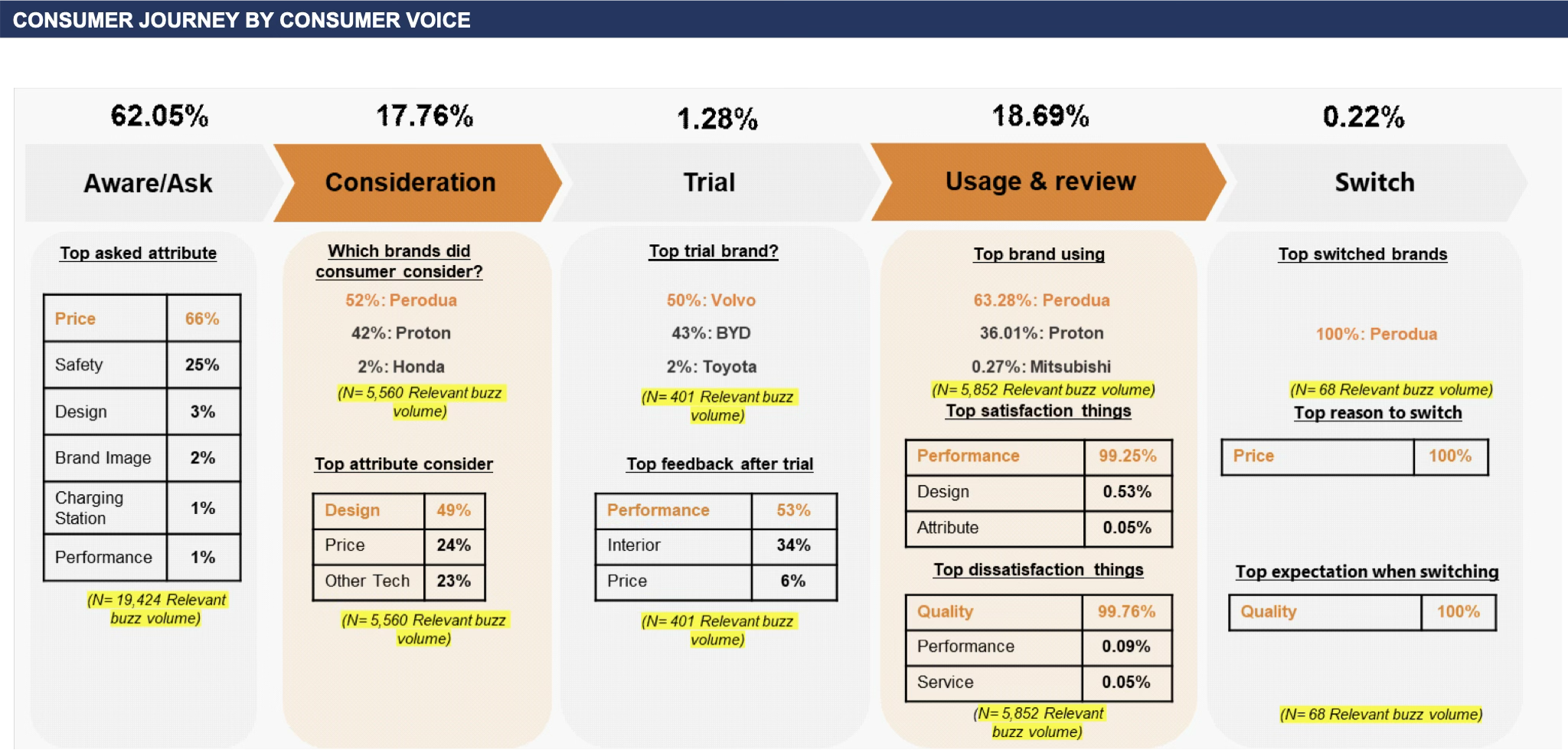

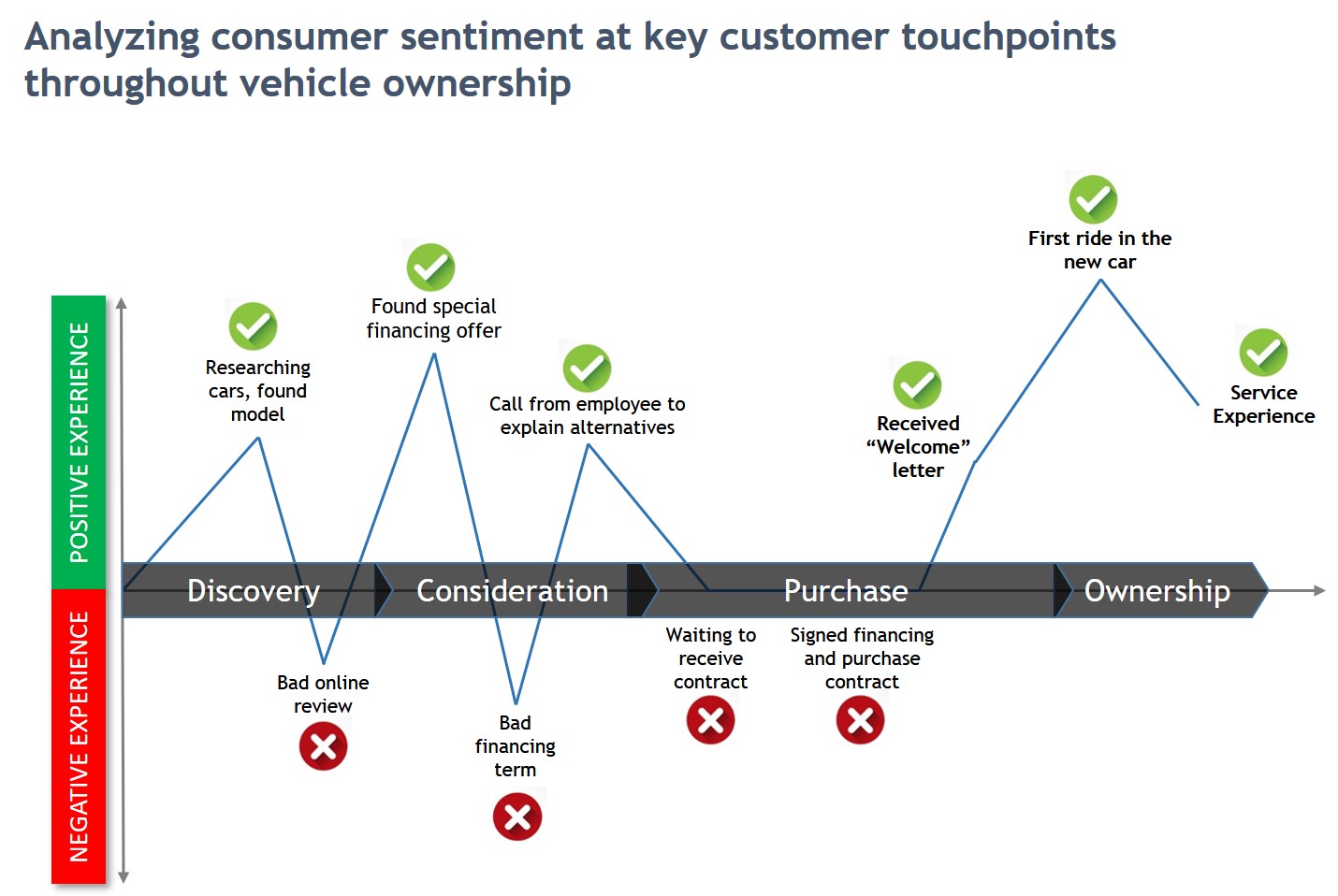

By mapping social data into the customer journey framework, our social analytics research on major car brands in Malaysia showed 62% of the consumers are fully aware of the price offer by car brands including its safety features and design. However, in reality only 17.7% of the users express some level of interest with 1.28% are serious in testing the vehicles.

For existing car owners, their brand loyalty towards a car brand is relatively high with 0.22% expressed some level of interest in switching brands. For example, our social media analysis on Toyota and Honda showed high level of brand loyalty, with many are willing to trade-up by purchasing new models whilst sticking to the same brand.

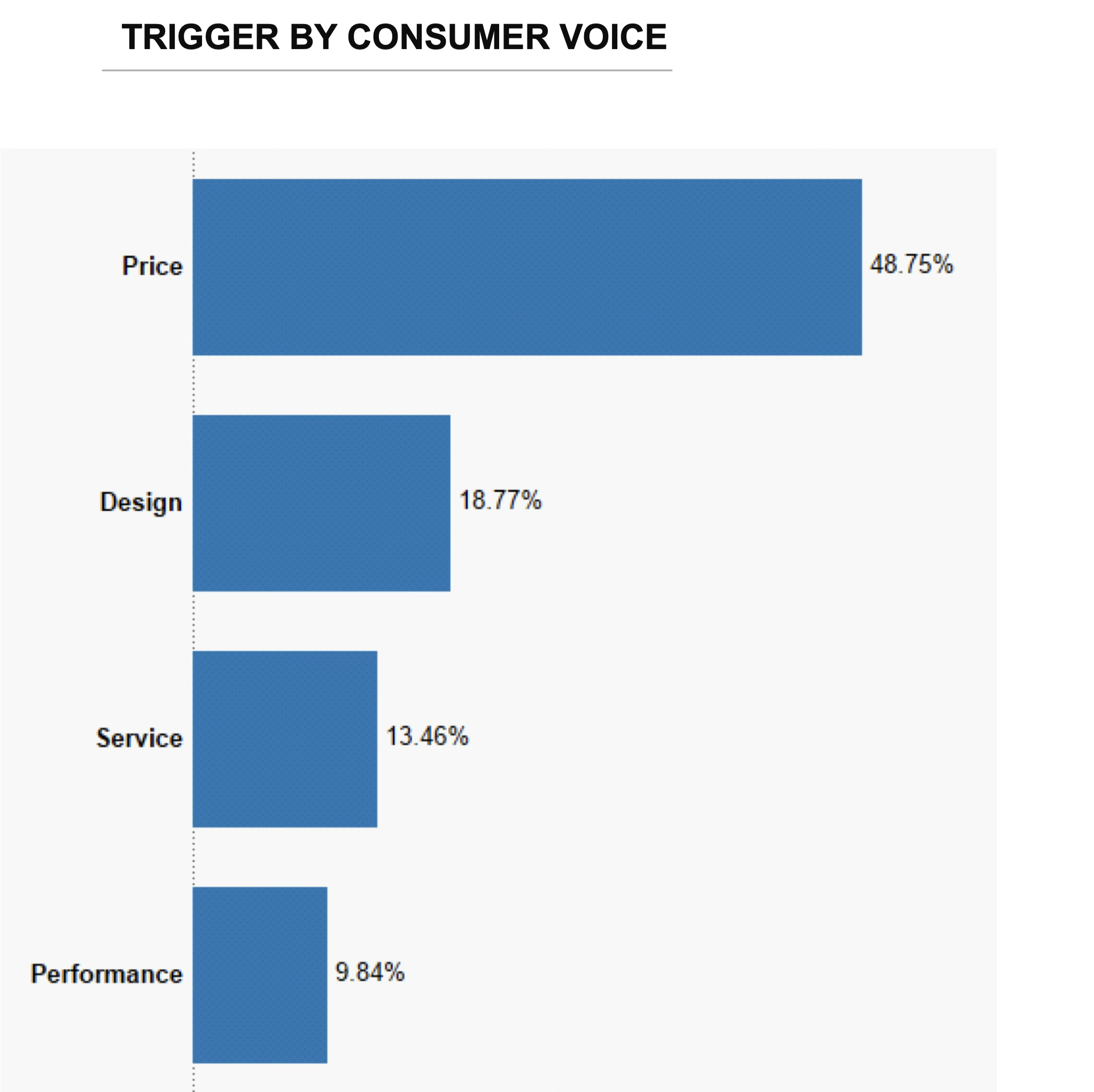

There are other benefits of social listening and using the best social data analytics provided by Berkshire Media on 27 car brands in Malaysia, we concluded that price is the most important deciding factor for buyers at 48.75%, followed by car design at 18.77% and the after sales service at 13.46%.

This demonstrate that social data analytics can bring greater insights on factors determining consumer purchasing behaviour which helps the automotive industry players plan for a better long term marketing strategies.

For the Malaysian market, social media data showed attractive prices offered by national car brands, easy accessibility of loan financing from banks (eg: up to 9 years with zero downpayment) and sporty practical design excite the consumer even more, enabling more social conversations and discussions amongst young buyers below 28 years old.

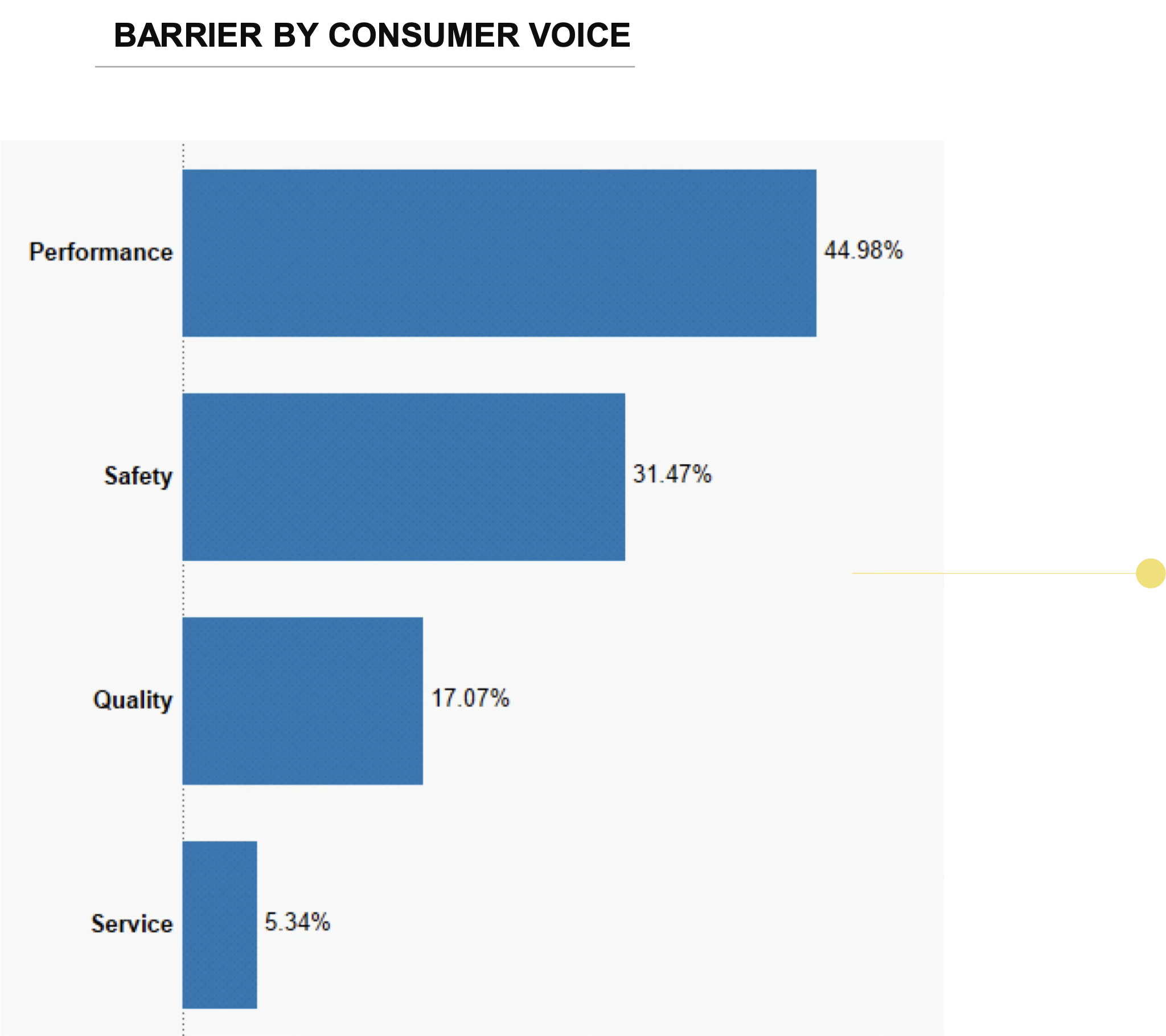

Meanwhile, conversation barrier that deter consumers from purchasing a car brand in Malaysia include performance, reliability of spare parts and safety issues. Conversation barrier using social analytics from social listening tool help car manufacturer and marketers to highlight certain features and to better educate the consumers as part of their on-going improvements and product development.

Social data analysis provided by Berkshire Media on 27 car brands from 2022 to 203 showed users are more concerned about the vehicle’s performance at 44.98%, followed by the safety features offered by car manufacturers at 31.47%.

Our social analytics research data showed that car performance became the primary barrier of conversation among Malaysian consumers due to problems they faced, such as oil tank leaks and errors occurring on some of the cars’ display meters – notably in Proton and Perodua. Netizens lodged complaints and highlighted the issues on their social media platforms, aiming for swift action and ensuring that people are aware of the response from the car company.

Car Brands continue to use Social Media as the main platform to Capture New Customers

Automotive car manufacturers are increasingly aware and the usage of social media and online platforms to drive and influence consumer purchasing behaviour are increasingly important in 2025.

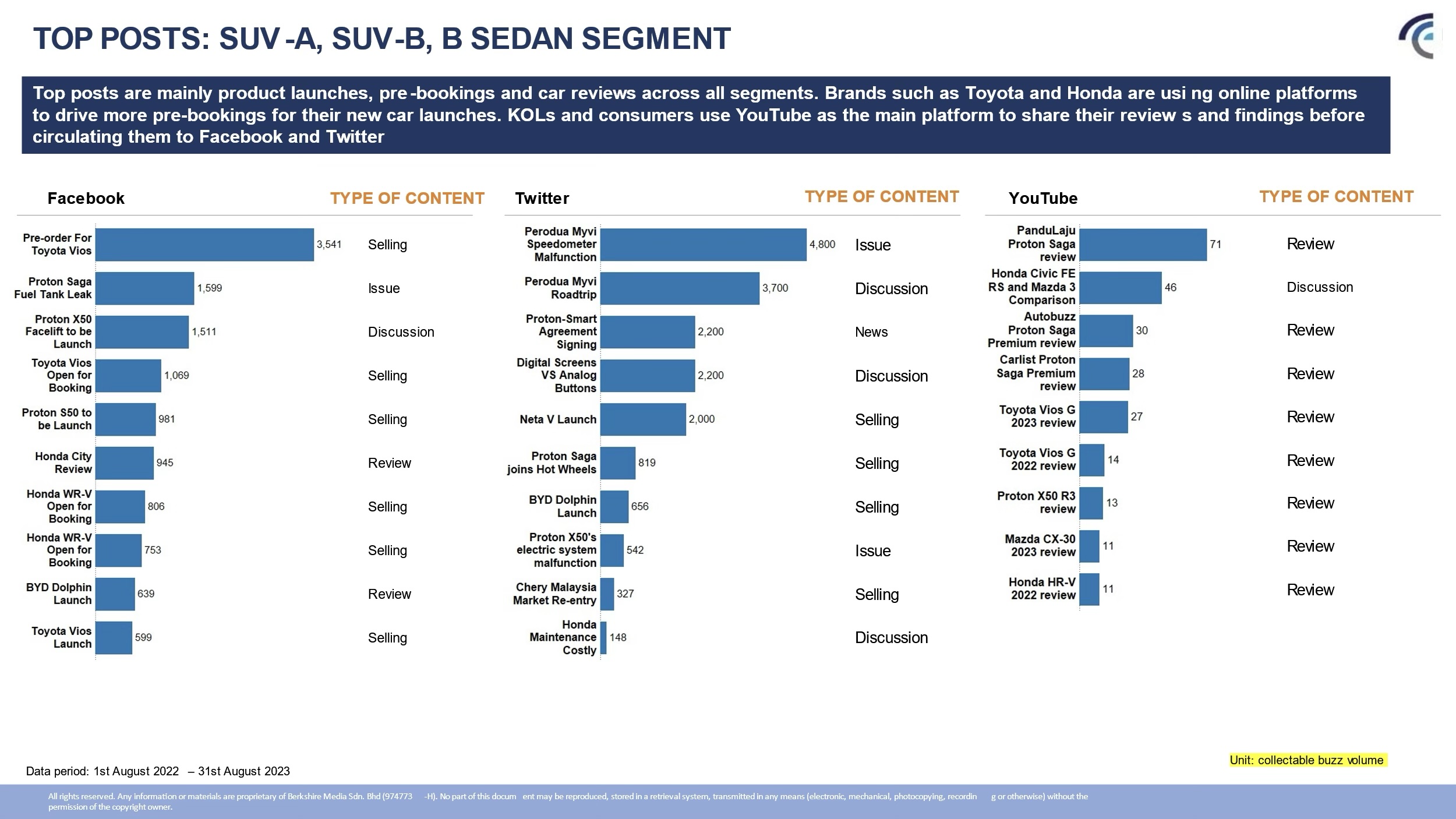

This trends prompts the need to leverage on social listening tools to monitor, analyze and make sense of these “noisy” data (through data cleaning). In addition, car reviews articles by prominent car review blogs such as Paul Tan are no longer seen as effective if the output do not translate to meaningful conversations, discussions or influence the consumer for a test drive of the the weekend.

Social media monitoring can help analyze the marketing investment (or ROI) from car reviewers or publishers such as Paul Tan, Kareta and other automotive media publishers.

Our analysis showed the Proton, Toyota and Honda are top 3 car brands that recorded highest online user engagement and that contributes to amongst the top highest car sales in Malaysia.

“Consumers are getting more price sensitive when it comes to buying cars in Malaysia. Reading online reviews, forums discussions and social media conversation help them to make better decisions” said Shahid Shayaa, Founder and CEO of Berkshire Media. He added that misinformation and unverified social posts continue to affect car brands in Malaysia.

Berkshire Media analyzes various vehicles segments in Malaysia using its advance social data analytics, sourcing public conversation across multiple social platforms such as Facebook and Youtube, news coverage and marketing events to gain better consumer insights, manage reputation risk for car brands and to build greater consumer confidence.

“Our analysis showed that social analytics helps car manufacturers drive more sales in certain segments by marketing attributes that are relevant to customers such as colour, design or even interior. This goes beyond price or discount offers” added Fatin Nadia, Director of Berkshire Media.

Our analysis showed that Facebook platforms are mainly used by car brands such as Honda, Toyota, Proton and BYD to drive sales and marketing – especially on their new car models, including event launches. At the same, Youtube are used by 3rd party car bloggers and influencers mainly focused car reviews with long videos of up to 15 minutes on average.

The SUV segment in Malaysia remains highly competitive and the use of social media marketing in the automotive industry is focused on driving visitors to their showrooms for test drives.

Social listening tool provides insights to attributes that will attract buyers to visit the showrooms and to test drive new cars. This level of data analytics sets a new frontier to help data-driven marketing strategies for car brands in Malaysia.

Analyzing Consumer Sentiment of Vehicle Ownership

Another powerful advantage of social media monitoring is analyzing the consumer sentiment at various customer touchpoints throughout his/her vehicle ownership.

This brings more perspective and insights on the brand loyalty for automotive manufacturers.

BYD, Toyota and Honda are leveraging on social data and online media monitoring to harness what makes consumer stay loyal to the brand as new models are being introduced each quarter. Brand loyalty is a key driver for automotive enthusiasts in Malaysia.

Conclusion

Our research analysis demonstrates that there are tangible benefits of using social listening tool beyond improving customer complaints. Applying advance social analytics techniques, vehicle manufacturers and car brands can now get deeper and meaningful insights which help to understand consumer preferences, purchasing behaviour, brand loyalty and what makes them buy a specific vehicle segment (eg: SUV-A, SUV-B, or even EV).

In a highly open and liberalized market like Malaysia, car brands are using every inch of data, signals and nuances to plan better beyond offering low cheap prices to consumers. Each market presents a unique opportunity for social data analytics provider to bring greater value, and for Malaysia, social listening has evolved into a complex data-mining activities.

To avoid pitfalls from using social listening tools (system) on your own, stick with social data analytics service provider that bring clean set of data that are useful if you are serious about analyzing the levers that brings more sales and awareness for your business.

Why Trust Us

Berkshire Media helps car brands to deliver more actionable insights from social data. The company is amongst the best social analytics company in Malaysia that combines the best social listening technology, data processing and backed by automotive industry experience. Established since 2012, the company has strong track record in managing brand reputation, issues management and helping data-driven marketing team to enhance sales and operational improvements. Its proprietary sentiment detection engine SENTIROBO® is highly regarded amongst the data analytics community, giving greater accuracy in anticipating reputation risks, or to assist future marketing activities. Additionally, the Founder and CEO of Berkshire Media, Shahid Shayaa is an automotive engineer, having involved in R&D activities for a large automotive brand in Malaysia. Along with a dedicated team of domain analysts, data scientists who are also car enthusiasts, this makes the company amongst the best social listening and analytics service company in Malaysia for car brands.

About the Author

Shahid Shayaa is the founder and managing director of Berkshire Media. He specializes in data-driven communication strategies and insights using social data analytics, social media monitoring tools and machine learning text algorithms for more than 13 years. As an expert in the field of media monitoring, issue management and reputation risks for companies, his deep involvement in various research studies in this field and published various scientific papers on social data analytics, sentiment analysis and back-end algorithms on consumer sentiment, emotions and behaviour for marketers and campaign managers.