Introduction

Proton’s first all-electric gamble, the e.MAS 7, burst onto the scene on 16 December 2024, a bit like a durian at a tea party: spiky expectations on the outside, surprisingly creamy value within. But with the RM 4,000 incentive to replace your 20+ year old car coupled with the recently announced reducing-balance interest rate in Budget 2026, Proton eMAS 7 could be a top choice if you are planning an upgrade.

Proton eMAS is an entry-level mid segment EV for Malaysians. For the love the country, should you buy one given that BYD, Jaecoo and iCaur offer similar value?

Priced from RM 105,000 to RM 119,800, Proton eMAS7 lands to the category of “Are you sure that’s an EV?” bracket, making brand rivals such as BYD, Jaecoo, iCaur weepy. Surely social media buzz (with high volume and velocity) including the attractive price alone may not attract you to buy one tomorrow – but rather distorts your final decision due to layers of emotional excitement (at times viewed as buying pressure) from your wife (or wives), parents and grandparents – notably after endless visits to showrooms or from the endless hours of reading car reviews on Paul Tan, Autobuzz, ZigWheels and other sites.

Design (Exterior)

From news, reviews and social chatter, the rear of Proton eMAS 7 is praised more than the front. The full-width lightbar/taillight repeatedly gets called out as stylish, premium and “Porsche-like,” – with similar design cues to Porsche Macan and Cayenne while the front’s minimalist, grille-less face splits opinion—clean to some, a bit anonymous to others. Granted, it sparks excitement and generate the required social media buzz. But though it looks similar, comparing Proton eMAS 7 vs. Porsche Macan/Cayenne is like comparing local nasi lemak to Michelin-starred fine dining at Dewakan.

Driving Impression

First drives by the local motoring press exude excitement and approval of the national car brand – commonly judged as a “decent drive” and—the occasional compliments of “rather impressive as a static object,” a term journalists would describe eMAS 7, establishing it as “looking expensive without needing a yacht.”

But with plethora of jargons and descriptors to describe eMAS 7 EV performance such as charging capacity (KwH), battery capacity (kwH), 0-100kmg acceleration, the EV motor reliability, etc – will that convince you to buy one?

Yes, and lets not forget the screens, modes and more icons than your IPhone. First impression, we find the overall vibe is calm, modern, and unexpectedly posh for the Harimau-inspired sticker. If Proton wanted to signal it’s serious about the electric future, this is a horn blast in traffic: clear, loud, and—dare I say—rather charming.

Consider us intrigued for now, but let’s see what consumers really say about eMAS 7 from our honest data-driven approach.

Technical Specifications: Proton eMAS 7

| Feature | eMAS7 Prime | eMAS7 Premium |

| Powertrain | ||

| Motor | Single, front-mounted | Single, front-mounted |

| Power | 160 kW (215 hp) | 160 kW (215 hp) |

| Torque | 320 Nm | 320 Nm |

| Performance | ||

| 0-100 km/h | 6.9 seconds | 7.1 seconds |

| Top Speed | 175 km/h | 175 km/h |

| Battery | ||

| Type | Aegis Short Blade Lithium Iron Phosphate (LFP) | Aegis Short Blade Lithium Iron Phosphate (LFP) |

| Capacity | 49.52 kWh | 60.22 kWh |

| Range (WLTP) | 345 km | 410 km |

| Charging | ||

| AC Charging | 11 kW | 11 kW |

| DC Fast Charging | 80 kW | 100 kW |

| DC Charging Time (30-80%) | ~20 minutes | ~20 minutes |

| Dimensions & Weight | ||

| Length | 4,615 mm | 4,615 mm |

| Width | 1,901 mm | 1,901 mm |

| Height | 1,670 mm | 1,670 mm |

| Wheelbase | 2,750 mm | 2,750 mm |

| Kerb Weight | 1,662 kg | 1,765 kg |

| Boot Space | 461 liters | 461 liters |

| Wheels & Tires | ||

| Wheel Size | 18-inch Alloy | 19-inch Alloy |

| Tire Size | 225/55 R18 | 235/50 R19 |

| Interior | ||

| Instrument Cluster | 10.2-inch Digital | 10.2-inch Digital |

| Infotainment Screen | 15.4-inch 2.5K Touchscreen | 15.4-inch 2.5K Touchscreen |

| Sound System | Standard | 16-Speaker with Flyme Sound System |

| Head-Up Display | – | Yes |

| Ventilated Front Seats | – | Yes |

| Sunroof | – | Panoramic |

Consumer Sentiment & Insights

We deep-dive into consumers sentiment insights to analyze the collective wisdom, i.e a consensus of what others are saying about eMAS 7 from their ownership experience and first impression after seeing or test-driving the car for the first time.

Our data-driven approach utilizes social and media listening best practices by diving into online discussions, news and reaction from netizens based on key purchasing indicators (eg: affordability, design, performance, and after sales).

Additionally, we analyzed the consumer sentiment using proprietary algorithm SENTIROBO® to get a closer look in honest consumers reviews about Proton eMAS 7 based on short-term and long-term ownership experiences beyond first drives.

At a glance, Malaysians are generally receptive about the eMAS 7 with majority of them expressed strong positive sentiment at 57.8%. However, there are still considerably large fence-sitters who showed mixed reviews, less excitement and without strong purchasing indication that they are interested or will purchase one in future.

| Total Dataset | 500 |

| Positive Sentiment | 57.8% |

| Neutral Sentiment | 35.4% |

| Negative Sentiment | 6.8% |

What people like (mostly):

- Comfort & quietness in daily driving. Owners repeatedly describe the ride as calm and well-suited to city use; cabin noise is generally low for the class.

- Interior space & perceived quality. Lots of remarks about the spacious cabin, family practicality (strollers, child seats), and an upmarket feel versus price peers.

- Value for money. The package is widely seen as good value, especially when benchmarked against popular rivals; total cost of ownership benefits (home charging, running costs) also show up in owner notes.

- Momentum on software/infotainment. Apple CarPlay availability and iterative updates are viewed as steps in the right direction, softening earlier infotainment gripes.

What people don’t like / major complaints (neutral–negative)

- Software alerts & UX friction. Frequent mentions of over-eager warnings/alerts (e.g., speed limit chimes) and settings not persisting. These are the most common irritants, often landing as “mixed/neutral” rather than outright negative but still a friction point.

- Range vs. expectations. Real-world range is discussed with sober expectations relative to WLTP; not a deal-breaker for most, but it tempers enthusiasm in some threads based on long-term ownership of eMAS 7.

- Update pathways & clarity. A few consumers posted question what’s OTA vs in-service updates, and how quickly fixes roll out; consumers expectations are high given software-centric ownership.

- Service experiences (light volume). A small cluster mentions waiting times or minor service visits; overall volume is low in this pilot, but Proton owners’ groups are watchful about the varying level of service experiences by Proton.

Buying Indicators: What Do Consumers Say the Most About eMAS 7?

We analyzed consumers feedback, comments and reaction into categories that influence potential purchasing decisions by understanding what consumers are saying about eMAS 7. Our model serves as a proxy of a purchasing decision-making framework that effectively answer whether you should buy Proton eMAS 7 in future.

Repetitive (or similar) comments from consumer’s reaction based on first impression from media coverage, launch events, first-hand test drive experiences and long-term ownership were considered in this analysis – sourced from our social listening tools and human-verified data performed by our analysts.

| Indicator | Share of mentions* | What people keep saying | Example posts / sources |

| Performance (Driving · Tech · Comfort) | 38% | Smooth/quiet city drive, spacious cabin; range/charging speed and software/ADAS alerts are common pain points; Apple CarPlay rollout noted as a fix for earlier infotainment gripes. | In-depth review flagging noise/bugs and alerts; charging peaks ~120 kW; settings not saving; owner long trips and tour highlights; OTA/CarPlay update news. (Paul Tan’s Automotive News) |

| Affordability / Price | 27% | Seen as good value vs rivals, but early launch chatter compared specs/price to BYD Atto 3; owners call it “worth every penny” at its price point. | Launch pricing piece; owner value-for-money reviews. (Paul Tan’s Automotive News) |

| Design (Exterior · Interior · Aesthetics) | 23% | Consistently praised: “turning heads,” premium-feeling interior, space and practicality; visuals from tours and reels amplify positive sentiment. | Media/brand vox-pop reel; Instagram posts praising space/looks; first-drive notes. (Facebook) |

| After-sales service | 12% | Talk centers on OTA/software fixes, community groups sharing issues (buggy notifications, clock/settings), and service/response expectations; owners’ groups are very active. | Owners’ FB groups threads; complaint about software bugs; official updates/tests. (Facebook) |

Quick insights

1) Affordability / Price — 27% of chatter (mostly positive–neutral)

- Early conversations benchmarked e.MAS 7 against BYD Atto 3 on price/specs; some thought Proton could be sharper, but many owners later describe the package as strong value for money. Paul Tan’s Automotive News

- Owner review snippets note it “absolutely worth every penny” and “interiors/space feel above price.” Zigwheels

2) Design (exterior, interior, aesthetics) — 23% (largely positive)

- “Turning heads” at launch; repeated praise for cabin space and perceived premium feel. Facebook

- Instagram/photo dumps from enthusiasts highlight practicality and looks. Instagram

- First-drive pieces call it “impressive as a static object,” comparing well to class rivals. Paul Tan’s Automotive News

3) Performance (driving, tech, comfort) — 38% (mixed: comfort positive, software/range mixed)

- Reviews point to quiet, soft ride suitable for city driving; owners confirm daily comfort. Reddit+1

- Common friction points: WLTP vs real-world range expectations and frequent system alerts/bugs; DC fast-charging peaks around ~120 kW in owner reports. Reddit+1

- Media/owner tours show long journeys and real-world efficiency stories (including a live-streamed 352 km+ run). Zigwheels

- Recent update headlines about Apple CarPlay (wired/wireless) improved earlier infotainment complaints. Paul Tan’s Automotive News

4) After-sales service — 12% (neutral–watchful)

- Conversation clusters in owners’ Facebook groups around software quirks (e.g., clocks, alerts), expectation of OTA fixes, and service center responsiveness. Facebook+1

- Owners share 11k-km experience threads and troubleshooting tips, indicating active community support alongside official comms about durability testing (“6 Devil Series”). Facebook+1

Will consumers buy one?

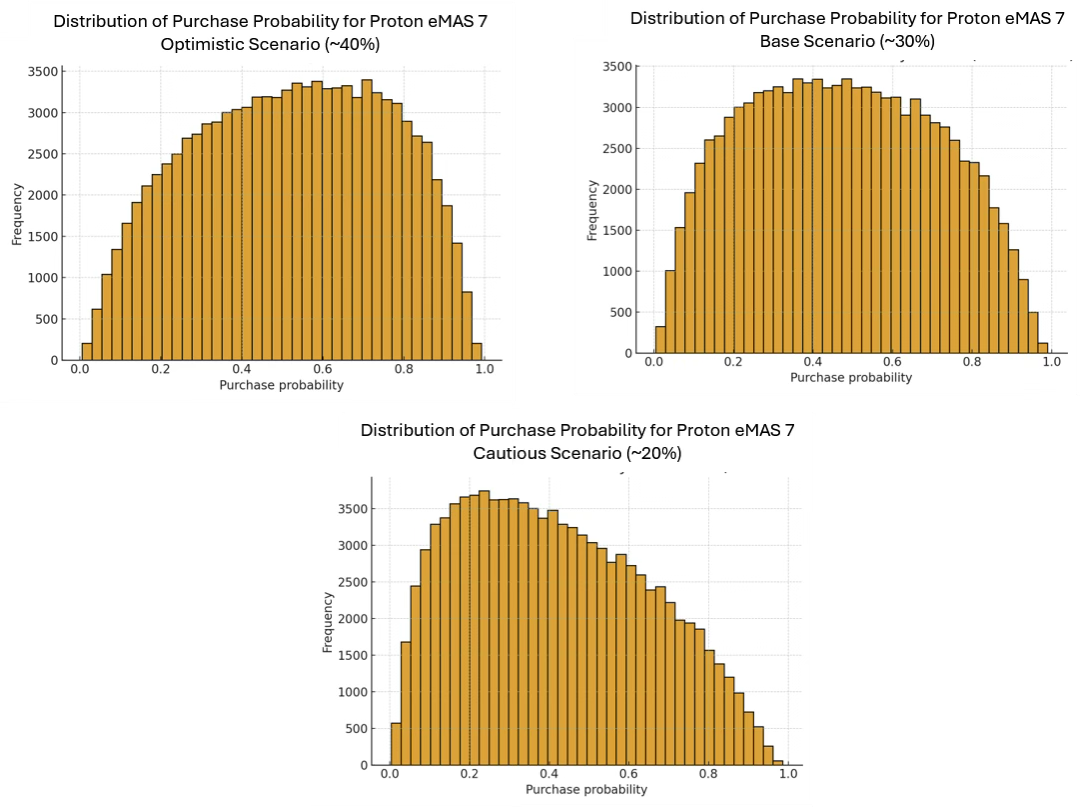

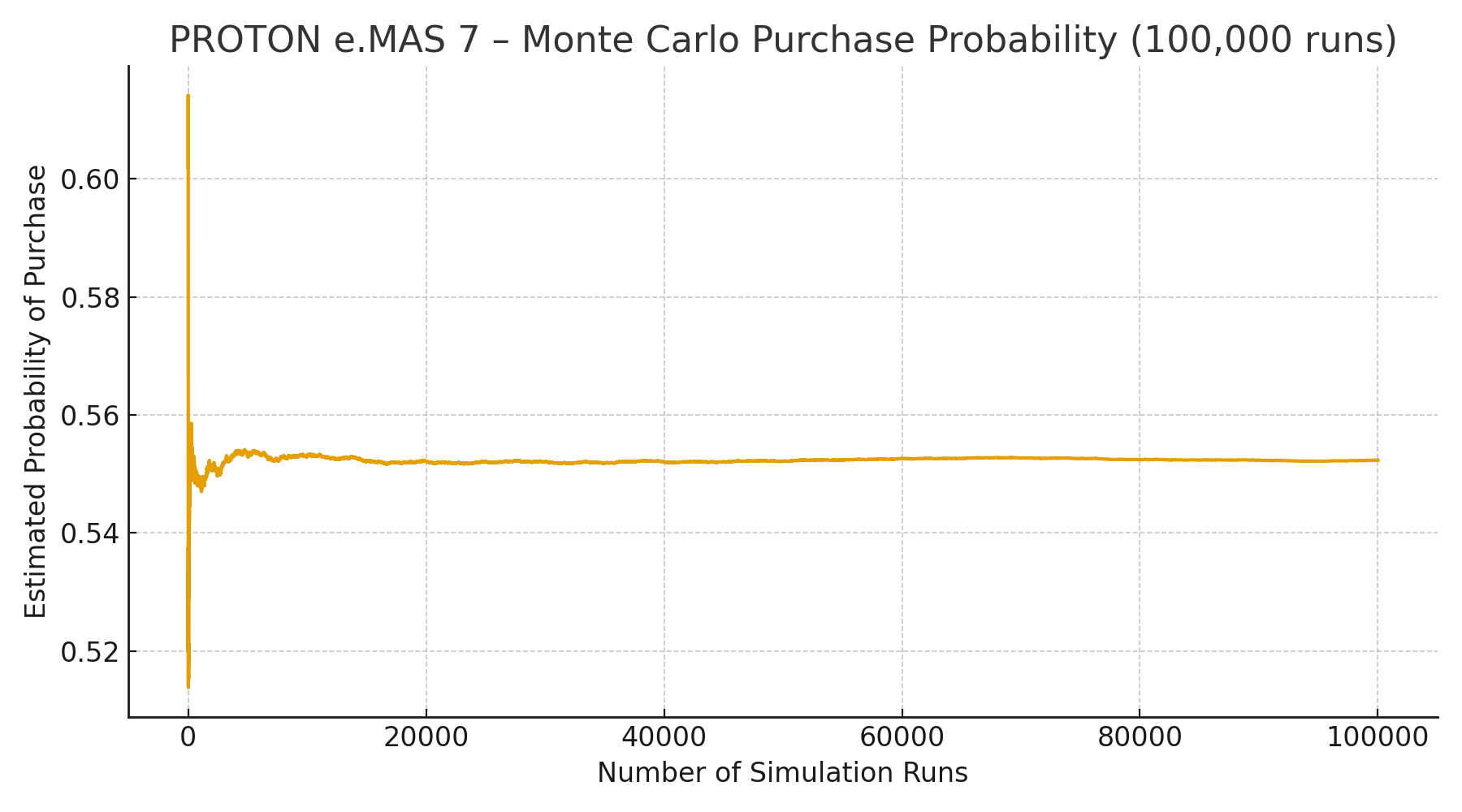

Based on our modeled analysis of 500 consumer discussions and a 100,000 Monte Carlo test run simulation, the average probability of Malaysians buying the Proton e.MAS 7 sits around 30% at a baseline scenario, rising toward 40% in optimistic conditions and dipping near 20% in cautious conditions.

In an optimistic scenario, the mean probability of purchase eMAS 7 sits around 60% to 80% chance, which is relatively high given the affordability vis-à-vis what they will get in terms of performance and tech.

On average, we estimate there is a 55% chance of Malaysians will actually purchase Proton eMAS 7 based on our probablistic model. This suggests consumers are generally consists of fence-sitters with wait-and-see attitude.

Main factors that may increase the likelihood of buying is Price/value, largely due to the price-sensitive buyers who are concern on the monthly cost of loan repayment vis-à-vis the specifications that they are getting. And this anchors on marketing efforts to educate and convince the consumers, besides the technical explanation by sales representatives.

At the same time, Performance & Technology (i.e quiet, comfortable driving and dependable range) builds another confidence layer for consumers, making it a key factor in purchasing eMAS 7.

For Design/space, it helps families justify the switch or upgrade from their existing ownership. Charging access is the key contextual hurdle: easy home or workplace charging lifts intent; patchy public options suppress it.

Finally, after-sales support by Proton and regular software updates can swing fence-sitters by reducing alert/UX annoyances and clarifying what fixes arrive over-the-air.

Key Levers To Achieve Higher Consumer Confidence & Sales

Our consumer insights revealed there are three key levers that will help Proton executives find new ways to increase the probability of consumers buying eMAS 7:

- Affordability: tactical promos/hassle-free financing can shift consumer purchasing intent by riding on Government-induced incentives. Value for money is Proton’s greatest strength.

- Performance/Tech polish: reduce alert noise, ensure settings persist, clarify OTA timelines.

- After-sales reassurance: Proton may publish fix logs, SLAs, to build better consumer confidence and show resolved technical issues. This may convert the fence-sitters to a firm “yes.”

Loan Repayment: Can you afford it?

Proton eMAS 7 may be affordable for a family with a household income of above RM 6,ooo per month, and of course you need to have a good credit history and financial health.

Based on the Budget 2026 announcement of reducing-balance on Effective Interest Rate (EIR), consumers may enjoy more savings when buying Proton eMAS 7, with an estimated reduction of loan monthly payment from RM 1,138 (at 5.0% interest per annum) compared to RM 1,356 per month based on existing flat-rate interest of 3.5%.

| Variant | Interest | Loan Amount (RM) | Monthly Repayment (RM) |

| eMAS7 Premium | Flat 3.0% p.a. | 111,420.00 | 1,310.22 |

| eMAS7 Premium | Flat 3.5% p.a. | 111,420.00 | 1,356.64 |

| eMAS7 Premium | Reducing (EIR) 4.5% p.a. | 111,420.00 | 1,256.55 |

| eMAS7 Premium | Reducing (EIR) 5.0% p.a. | 111,420.00 | 1,283.25 |

| eMAS7 Premium | Reducing (EIR) 5.5% p.a. | 111,420.00 | 1,310.30 |

| eMAS7 Premium | Reducing (EIR) 6.0% p.a. | 111,420.00 | 1,337.68 |

| eMAS7 Prime | Flat 3.0% p.a. | 98,820.00 | 1,162.05 |

| eMAS7 Prime | Flat 3.5% p.a. | 98,820.00 | 1,203.23 |

| eMAS7 Prime | Reducing (EIR) 4.5% p.a. | 98,820.00 | 1,114.45 |

| eMAS7 Prime | Reducing (EIR) 5.0% p.a. | 98,820.00 | 1,138.14 |

| eMAS7 Prime | Reducing (EIR) 5.5% p.a. | 98,820.00 | 1,162.12 |

| eMAS7 Prime | Reducing (EIR) 6.0% p.a. | 98,820.00 | 1,186.41 |

Conclusions

Proton eMAS 7 brings a tangible value proposition to small families, young work professionals and existing non-EV owners who plan to switch to an affordable EV. Whether you should buy one today or in future bog down to how you perceive the overall value of Proton under the new ownership, by considering the monthly loan repayment vs the technology and other performance measures that elevate your total ownership experience.

With substantial savings from your monthly loan repayment under the new Budget 2026 incentives and revised interest rate, Proton eMAS 7 could remain a top choice for a first-time car buyers.

Granted, Proton eMAS is not your forever car, but as a daily car for your grown-up children, wife and perhaps your father, it presents value for money deep-rooted in the long history of national pride.

Our analysis concludes that Malaysians may consider buying the eMAS 7 backed by growing consumer confidence of its technology, performance and value-pricing. However, due to the stiff competition by other brands for similarly priced segment, there is a small probability of consumers who are relatively cautious to make the purchase and remain loyal to the national carmaker

Note: Limits & Caveats

Please note of the limits of this probabilistic approach in predicting whether consumer will purchase Proton eMAS 7 as explained below:

- Data are derived from public conversation, not a random sample of the total addressable market. Therefore, future recommendations should include data analysis that is calibrated against survey data or funnel metrics (test drives, bookings).

- The logistic intercepts (20/30/40% baselines) are scenario choices, and does not represent the truths. They should be tuned to real conversion funnels by market.

- Correlation ≠ causation: factor “importance” is a directional proxy, best used for prioritization for future communications or operational improvements, not for causal claims.

Free Consultation & Demo

About the Author

Shahid Shayaa is the founder and managing director of Berkshire Media. He specializes in data-driven communication strategies and insights using social data analytics, social media monitoring tools and machine learning text algorithms for more than 13 years. As an expert in the field of media monitoring, issue management and managing reputation risks for companies, he is involved in various research studies in this field and published various scientific papers on social data analytics, sentiment analysis and back-end algorithms on consumer sentiment, emotions and behaviour for marketers and campaign managers.

His research work and studies have been cited more than 467 times, inspiring new research in the field of social analytics in Malaysia. You may view his work here.