There are 3.46 million units of cars sold each year in ASEAN. With total vehicles recording a 4% decline in 2019, economic growth has slowed sharply in most ASEAN countries largely due to falling exports, prompting central banks to cut interest rates aggressively to support domestic consumption.

The recent outbreak of COVID-19 in 2020 has added more economic uncertainties and anxieties for the automotive industry. An industry which is heavily reliant on a massive workforce, the size of the global automotive industry is worth US$800 billion – an economic impact that we simply cannot ignore.

Realising the magnitude of impact, what actions can automotive manufacturers take in order to stimulate demand and navigate through this perfect storm?

Our team performed a deep-dive analysis from social media data to understand conversations related to existing consumer demand and potentially predict future demand in ASEAN countries such as Malaysia. Malaysia is a unique country as it has one of the highest car ownerships per capita, with more than 600,000 new motor vehicles sold each year.

Our initial research from public polls conducted on social media in April 2020 showed that 84.3% of Malaysian consumers may not purchase new vehicles or upgrade their existing ones in the next three to six months.

As consumer demand (and consumer behaviour) can be rather erratic, a long-term trend is required to reaffirm consumer’s purchasing intent in light of anxieties and other emotional factors.

That brings us to a rather interesting point.

Can social data determine consumer demand and shape future strategies?

Through data science techniques, social media data can provide valuable insights to companies to enable strategic decisions and actions. The World Bank and European Central Bank have used social media data to predict consumer confidence and GDP growth since 2014.

Consumer Analysis & Insights

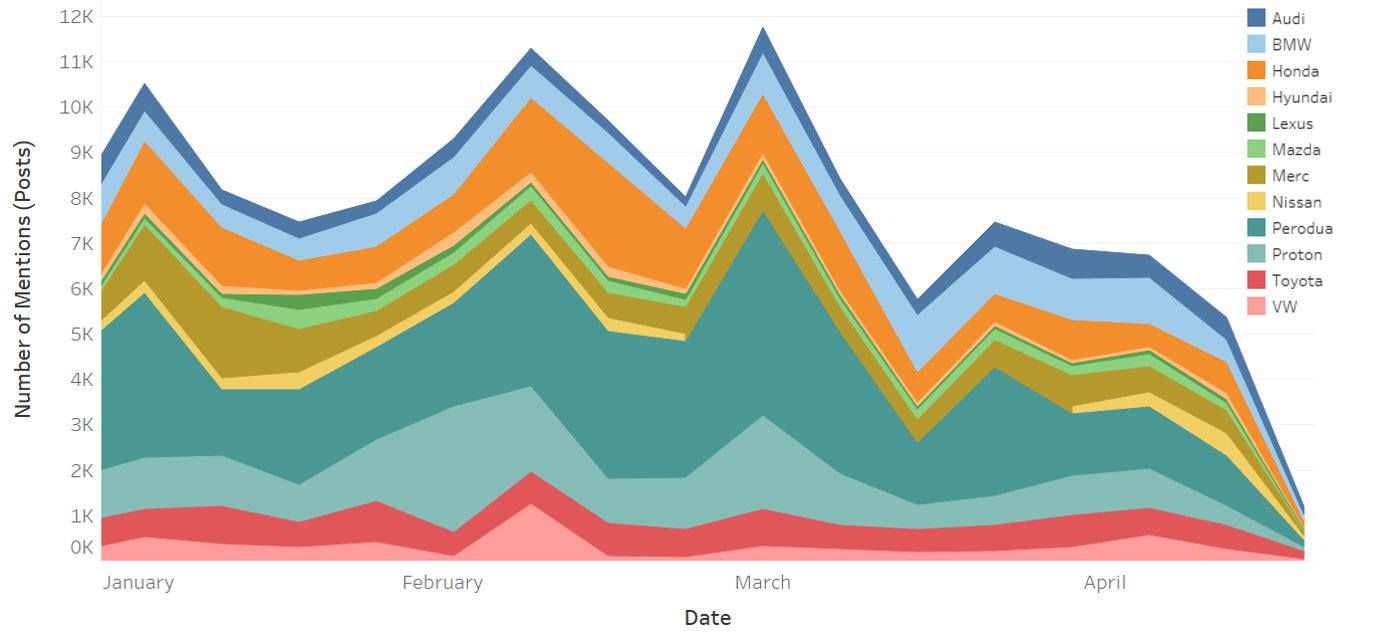

Our analysis recorded more 133,588 mentions (i.e. social media posts) related to top automotive brands in Malaysia between January to late April 2020. Mentions include social media posts by car enthusiasts, community groups and official car brands.

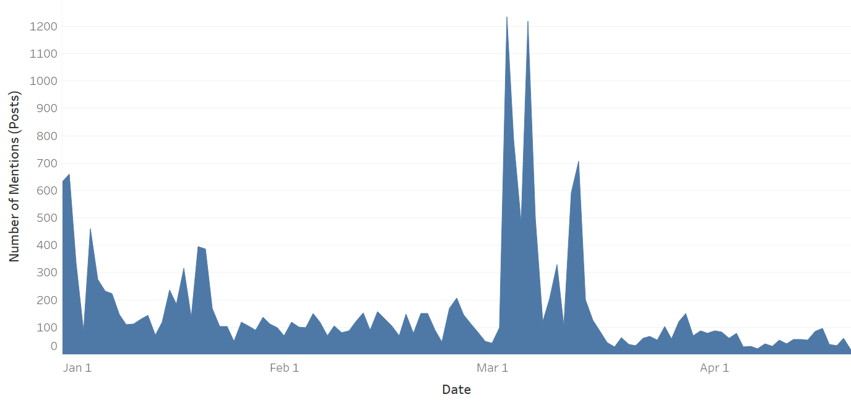

Meanwhile, we analysed the purchasing intent by identifying keywords and keyword derivatives which are closely related to intention to purchase such as “will buy” or “thinking to buy” in multiple languages including local dialects and slangs.

Learn more about how we predict consumer behaviour and consumer confidence here.

Figure 1: Total mentions (i.e. posts) from social media platforms for top 12 automotive brands in Malaysia. Source: Berkshire Media Team Analysis

Figure 2: Total mentions (i.e. posts) from social media platforms on consumer purchasing intent. Source: Berkshire Media Team Analysis

Note: Our consumer analysis was performed by extracting data from multiple social media platforms based on public data. We conducted a two-step-process in order to derive the above results – i.e. data extraction and data cleaning before arriving at the above results. Sample size for top 12 car brands (n=133,588). Sample size for Purchasing Intent (n=18,500)

Our observations:

- 14% out of the total mentions expressed some form of interest to purchase a new vehicle or upgrade existing vehicles. There was a record peak observed in January and March due to promotion-induced demand, days before the first MCO announcement was made.

- The remaining 86% were conversations related to existing car ownership, dealership experience, vehicle servicing during MCO period and hire-purchase loan deferment from recently announced COVID-19 stimulus package.

- Active conversations on automotive brands on the first two months of the year – due to aggressive festival promotional offers during Chinese New Year by various automotive brands between January and February 2020.

- Volume of mentions across all automotive brands recorded a 40% drop after the Movement Control Order (MCO) was first announced on 16th March 2020. Conversations picked up between 16th March to mid-April before registering a rapid downward trend towards end of April 2020.

- National car manufacturers Perodua and Proton were the most frequently mentioned in social media conversations probably due to strong brand affinity associated with nationalism and good value for money. Notably, these two brands have been recording the most chatter in the last 24 months.

- Foreign-owned car brands such as Honda, Mercedes and BMW have been actively engaging customers since early this year with aggressive online promotions and test-drive sessions. Postings from car enthusiasts from these three brands were due to close competition between these two segments in the digital space.

Demand for New Vehicle Purchase Will Continue to Drop

Our analysis from social data and the poll survey showed that consumer demand for purchasing new vehicles has dropped significantly. By aggregating both sources of data, we can safely predict that at least 80% of consumers today in the current market conditions will not purchase a new vehicle in the next three to six months.

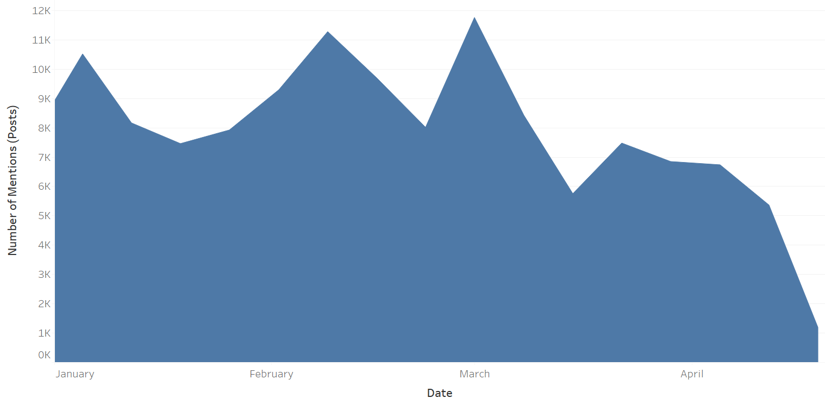

The rapid drop of conversations across 12 automotive car brands in Malaysia may indicate reduced interest from existing car owners or first-time buyers. This is consistent with the economic anxieties as consumers are curtailing spending on non-essential items.

As production and event-driven marketing activities are halted during the MCO period, this will potentially impact new vehicle sales even more in April until August 2020. Post COVID-19 will not record any significant change in demand as event-driven promotions and marketing activities are hampered due to continuous fear.

Figure 3: Total mentions (i.e. posts) from social media platforms for top 12 automotive brands in Malaysia. Source: Berkshire Media Team Analysis

Aside from the new vehicle purchase, the second-hand market for luxury supercars such as Porsches, Bentley, Ferraris and Lamborghinis remained robust with minimal price reduction based on data observed in Mudah.my and MotorTrader.

Impact to future car sales will be significant

The downward weekly trend from social data showed a reduction in consumer interest and demand. This can potentially be a leading indicator in predicting the new vehicle sales for each of the automotive car brands in Malaysia.

Here is our sales forecast after taking into account the latest purchasing intent and trend from social media data for the same period.

Passenger Vehicles Sales | Jan ’20 | Feb ’20 | March (F) | April (F) |

Honda | 6,060 | 1,759 | 960 | 435 |

Hyundai | 328 | 152 | 110 | 74 |

Lexus | 45 | 95 | 43 | 65 |

Mazda | 1,082 | 1,100 | 780 | 634 |

Nissan | 1,087 | 789 | 643 | 572 |

Perodua | 17,481 | 18,895 | 15342 | 12415 |

Proton | 8,506 | 9,974 | 7455 | 6732 |

Toyota | 2,618 | 2,838 | 2240 | 1455 |

VW | 369 | 311 | 220 | 140 |

Table 1: Existing sales data and forecasted sales. Source: Paultan.org and Berkshire Media Team Analysis.

How can automotive brands weather the storm?

Looking at the situation, where do that leave automotive manufacturers? Identifying innovative ways to reach out to consumers should be the first priority, and Ramadhan presents an opportunity to engage customers digitally and build a stronger brand loyalty.

Here are some insights from the latest global trends.

1. Innovation and industrial mobilisation to aid in medical equipment production amidst temporary plant shutdown

Across the world, automotive companies have largely responded to the pandemic by declaring temporary shutdown of their plants to curb the spread of COVID-19. Regardless, these plants were used to contribute to the production of medical supplies.

Homegrown brand Proton successfully delivered its first batch of 8,000 face shields for frontliners in the East Coast, while Perodua contributed medical supplies to an amount of RM2mil.

In US and Europe, Ford and General Motors have planned for ventilator and mask productions in a few of their facilities. General Motors for example, started building personal protective equipment (PPE) even before the invoking of the Defense Production Act by the Trump administration.

Ford is aiming for 50,000 ventilators to be produced within 100 days from late April. Daimler too, had started putting their global 3D printing network to work producing over 2,000 face shields while Mercedes-AMG F1 team along with UCL, have developed CPAP breathing aids for patients.

Resumption of business production for other automotive brands such as Fiat Chrysler, Aston Martin, Renault and Porsche, would most likely be from May onwards, similarly for the Japanese and Korean brands.

2. Marketing shift – the focus on wellbeing

How do car companies keep their brands at the top of their consumers’ minds in a confined environment with reduced vehicle usage? Audi for starters created The Drive, a slow TV virtual drive that takes viewers through Australian landscapes, offering a change of view at a slower, calming pace to help improve their wellbeing and improve brand desire.

Rolls-Royce launched a ‘Young Designer Competition’ for aspiring designers to try their hand at designing their ideal future vehicles. What was previously part of the Rolls-Royce employees’ Family Day Celebration, the competition is now open to the public as an escape from social-distancing measures implemented worldwide.

BMW’s newly-created page offers a variety of BMW-themed printable games meant for customers and their family members to joyfully pass time while keeping safe at home. Mercedes-Benz is tapping into customers’ creativity by offering printable colouring books for families, while the more serious designers and painters could create their own sketches and share design ideas.

3. Go car-shopping online

Companies are quick to adopt digital methods of purchasing and payment gateways on their sites, also driven by interest towards online purchasing of big ticket items such as cars. In Singapore for example, major authorized dealerships still see enquiries and deposit payments made fully online, without needing to meet the customer. Dealers for brands such as Toyota, Mazda, and BMW have been able to secure deposits fully online through digital showrooms and “online flash warehouse sales”.

Volkswagen Malaysia launched its eShowroom that operates round the clock and allows an online form submission to indicate interest in a specific car model in a preferred showroom. In the US, GM’s “Shop. Click. Drive.” program at selected dealerships enables customers to browse car models, receive a trade-in value estimate, conduct payment and schedule delivery fully online.

Credit: Volkswagen Malaysia Website

4. Coronavirus car payment plans

In efforts to maintain vehicle affordability in the US, Hyundai is among the car companies that have rolled out deferred payment plans up to three months for customers who have purchased selected vehicle models during the COVID-19 quarantine period.

Other brands such as General Motors and Ford Credit are offering selected customers interest-free financing for 84 months with deferred payments for up to 120 days and also giving customers the option to delay their first payment for an additional 90 days.

Meanwhile, had introduced a subscription plan to allow customers to break away from long-term loan commitment, while offering them greater flexibility without the need to worry about vehicle depreciation.

Credit: Volkswagen Malaysia Website

5. Keeping up with vehicle servicing

Dealers in Malaysia are mostly giving extensions to car servicing deadlines with no penalty, while Auto Bavaria is stepping up on its service offer to come to customers’ homes to conduct the car maintenance. Via iService, car maintenance scheduling is simply done via a hassle-free mobile app.

This service is ideal to those who are planning to stay home to minimize risk exposure from COVID-19 or other reasons.

Credit: Auto Bavaria Malaysia iService.

Closing Thoughts

Automotive players are quick to embrace digital innovations and creative marketing strategies to engage more customers during this challenging time. Tracking the effectiveness of such strategy means measuring the post-campaign conversations, mentions, views and other social media metrices.

However, there are few things that can ensure long term sustainability of a business, i.e brand loyalty. Brand loyalty is closely related to the past and present customer experience.

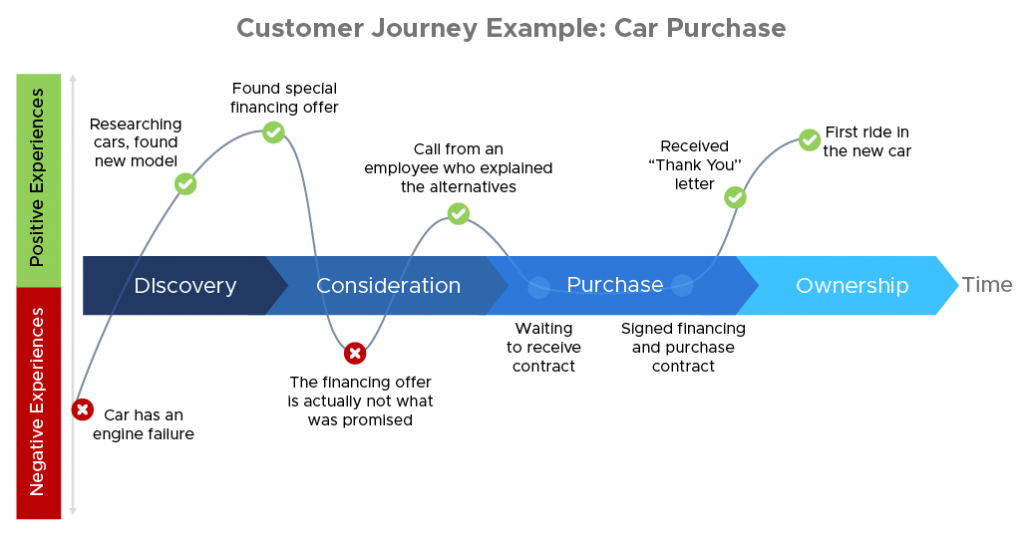

For an automotive player to be ahead of the curve, the entire customer journey for a car purchase should ideally be mapped out to understand strengths and weaknesses at every step of the customer journey. This is to improve the overall customer experience and increase brand loyalty.

Figure 4: A customer journey for a vehicle purchase and ownership.

Measurements such as sentiment analysis can be performed through regular monitoring to understand positive or negative experiences – that can potentially cause a change of consumer behaviour or shift in brand loyalty.

Beyond social media monitoring and sentiment analysis from social media data, automotive brands should focus more on communicating their brand values and new innovations via targeted campaigns to reach out the right audience.

Choosing the right strategy begins with a data-driven approach.

About the Author

Shahid Shayaa is the founder and managing director of Berkshire Media. He specializes in data-driven communication strategies and insights using social data analytics, social media monitoring tools and machine learning text algorithms for more than 13 years. As an expert in the field of media monitoring, issue management and reputation risks for companies, his deep involvement in various research studies in this field and published various scientific papers on social data analytics, sentiment analysis and back-end algorithms on consumer sentiment, emotions and behaviour for marketers and campaign managers.

One Response

Nice once