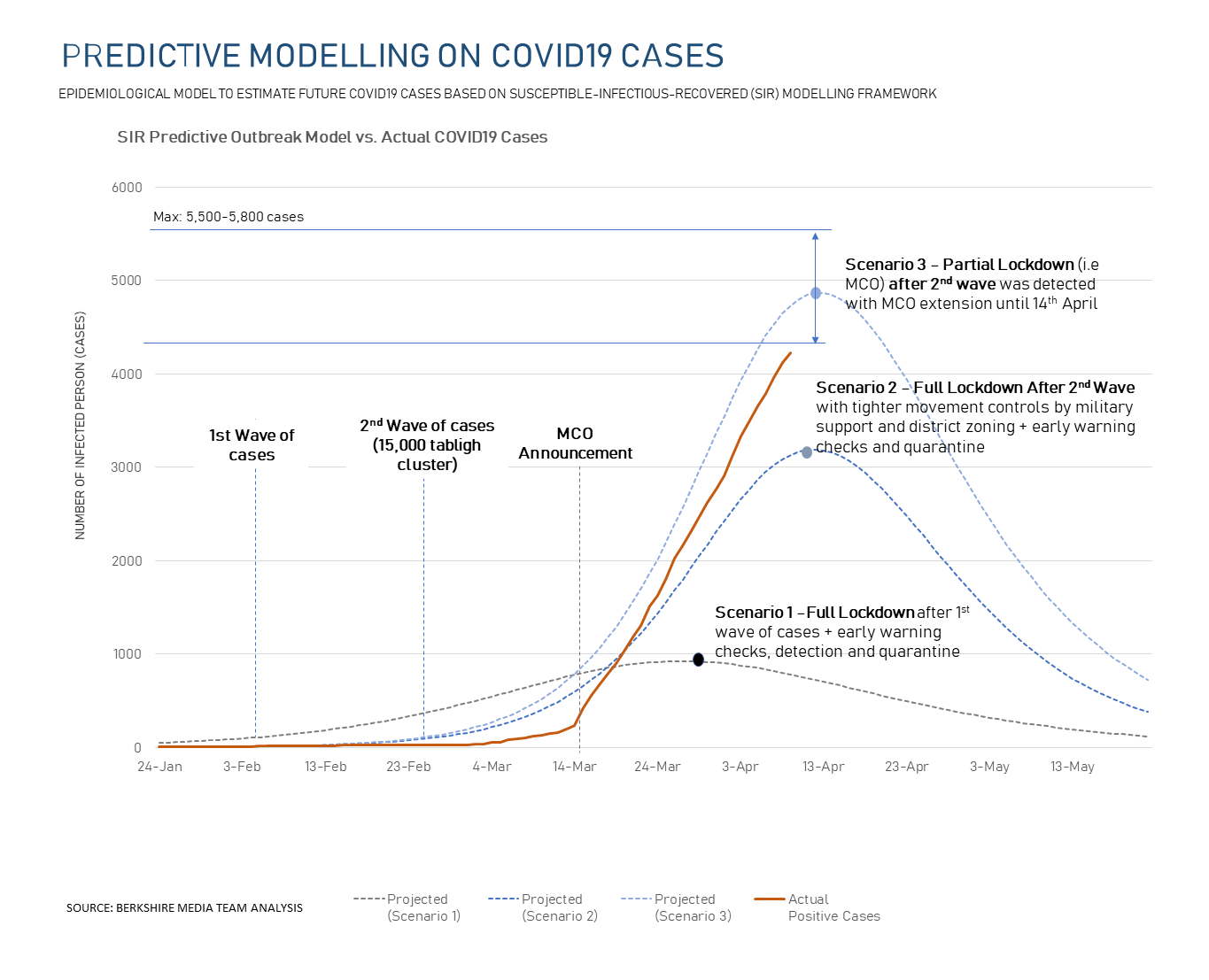

The global pandemic COVID19 has changed the way we live, work and play. Malaysia has surpassed the 4,000 mark on 8th April 2020.

Our internal prediction released in late March 2020 showed that the reported COVID19 will hit a conservative estimate of 5,000 – 6000 cases by mid-April based on the Suspected-Infected-Recovered (SIR) Model adopted by the World Health Organization (WHO).

Whilst the reported cases continue to increase with more tests being conducted by the Ministry of Health, we analyze how COVID19 affects Malaysians and the general public from a socio-economic standpoint.

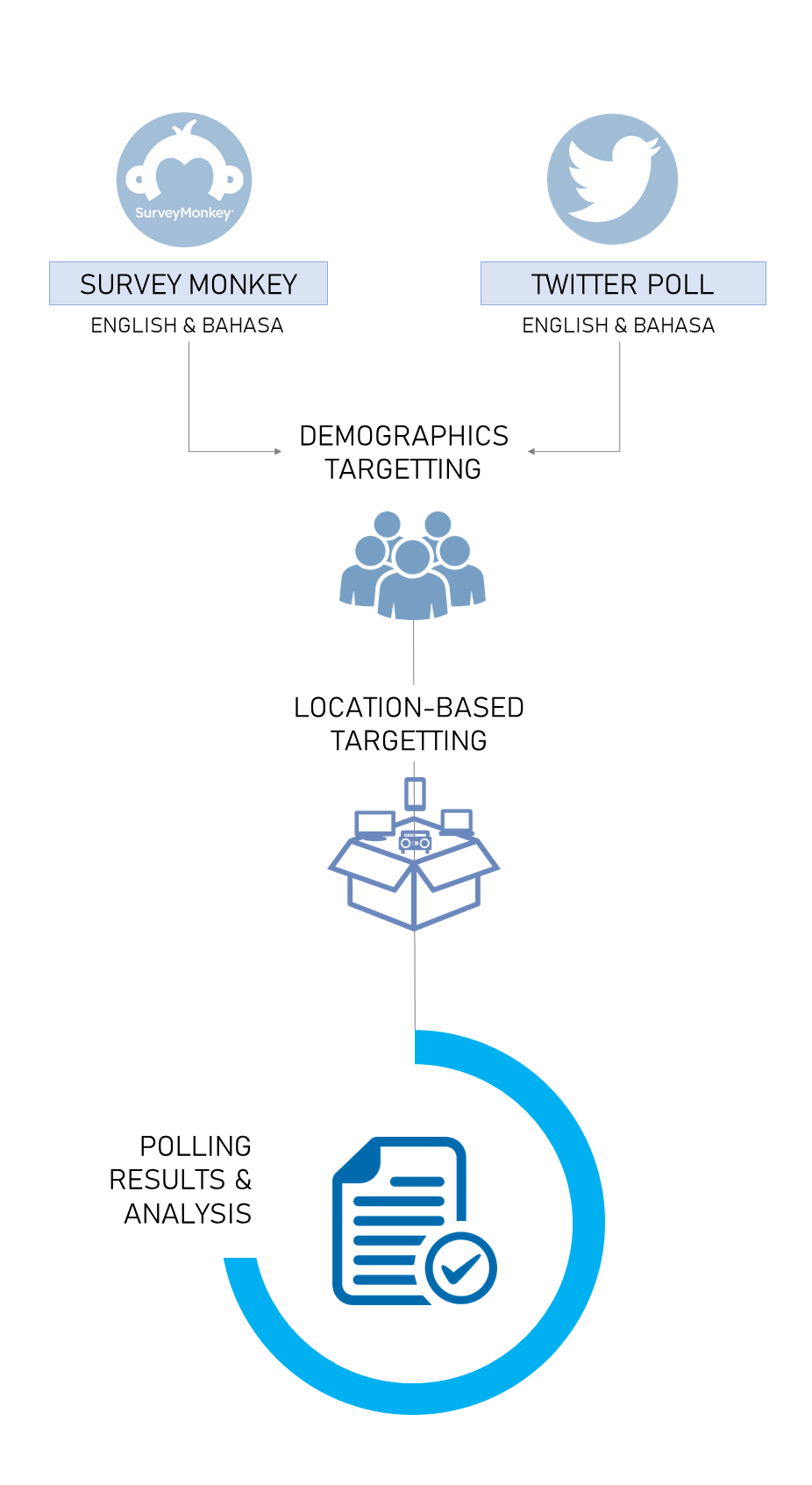

Our research methodology and approach were based on online-polling deployed in dual-language through Survey Monkey and Twitter polls.

A total of 15,340 respondents participated this survey across various demographics between 20-70 years – reflective of the total workforce demographics in Malaysia. The survey was deployed based on various locations in Malaysia through geo-location targeting.

Our goal is to identify trends and shifts in consumer behaviour that will hopefully be beneficial to companies, brands and other organizations.

Respondents' Profile

Age

Current Employment

Research Methodology

Poll Results

Here are the survey results based on the list of questions posted online.

(sample size, n=15,340)

Are you financially affected by COVID-19 crisis?

Do you have enough saving to last 6 months without jobs?

Do you think the Top 20% (i.e the rich) needs to be financially assisted by the Government?

Do you think you will feel safe in the next 6 months after MCO?

Would you go out to public places in the next 6 months?

Will MCO change your shopping habits?

Do you prefer working from home or at the office?

Would you buy or upgrade your car in the next 6 to 12 months?

Do you think the economy will recover in the next 6 to 12 months?

Do you think the economic stimulus package is enough for the B40?

Insights & Parting Thoughts

The consumer landscape will see a significant shift in the next 6 to 12 months as fear of COVID19 continues to create uncertainties, coupled with financial uncertainties amongst consumers working in selected industries.

The magnitude of financially impacted people with less than 6 months savings cannot be ignored despite strong public consensus that the bottom 40% (B40) is sufficiently supported by the economic stimulus package.

The Movement Control Order (MCO) lockdown has changed the consumer behavior with stronger preference to stay in and minimize public exposure where necessary. This will have tremendous negative impact to retailers and mall operators in the country – with possible recovery seen in first quarter of 2021.

In terms of consumer spending, we see a trend that online-shopping will continue to record strong growth in the next 6 months.

Although the gig-economy will remain robust, brick-and-mortar businesses continue to suffer – particularly automotive and other manufacturing-based industries.

Despite the gloom-and-doom, Malaysians recorded strong optimism that the economy will recover in the next 6 to 12 months and that’s the spirit that the country needs.

Learn more about how we use social media data to predict socio-economic issues and consumer behavior here.

About the Author

Shahid Shayaa is the founder and managing director of Berkshire Media. He specializes in data-driven communication strategies and insights using social data analytics, social media monitoring tools and machine learning text algorithms for more than 13 years. As an expert in the field of media monitoring, issue management and reputation risks for companies, his deep involvement in various research studies in this field and published various scientific papers on social data analytics, sentiment analysis and back-end algorithms on consumer sentiment, emotions and behaviour for marketers and campaign managers.

Disclaimer: This information published by Berkshire Media Sdn. Bhd. is for information purposes only and should not be regarded as providing any specific advice. Recipients should make their own independent evaluation of this information and no action should be taken, solely relying on it. Whilst this information is believed to be reliable, Berkshire Media makes no representation or warranty (express or implied) of any kind, as regards the accuracy or completeness of this information, nor does it accept any responsibility or liability for any loss or damage arising in any way from any use made of or reliance placed on, this information.

This report may contain forward looking statements which are often but not always identified by the use of words such as “anticipate”, “believe”, “estimate”, “intend”, “plan”, “expect”, “forecast”, “predict” and “project” and statements that an event or result “may”, “will”, “can”, “should”, “could” or “might” occur or be achieved and other similar expressions. Such forward looking statements are based on assumptions made and information currently available to us and are subject to certain risks and uncertainties that could cause the actual results to differ materially from those expressed in any forward looking statements. Readers are cautioned not to place undue relevance on these forward looking statements. Berkshire Media Sdn. Bhd. expressly disclaims any obligation to update or revise any such forward looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events. Unless otherwise stated, any views, data, forecasts, or estimates are solely those of the Berkshire Media Sdn. Bhd. as of this date and are subject to change without notice.